Every Pile, Any Time™

Get the Answers

You Need from Stockpile Reports

How much material do you have on hand? How much material did you have yesterday? How much will you have tomorrow?

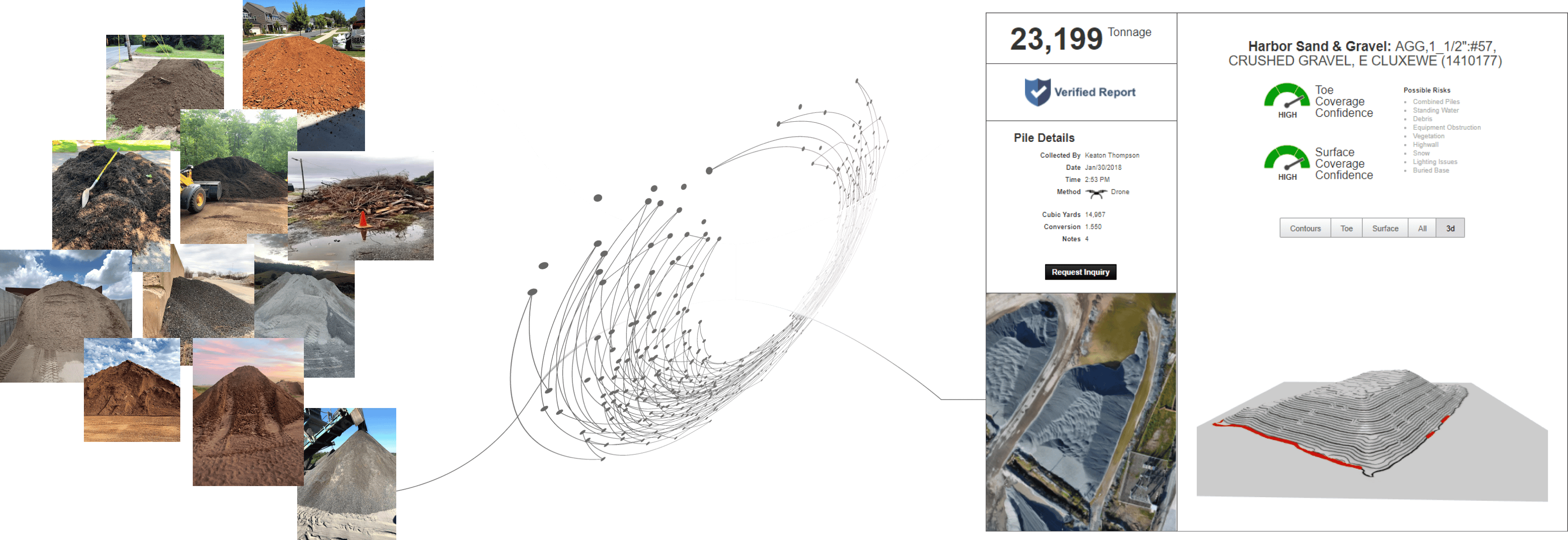

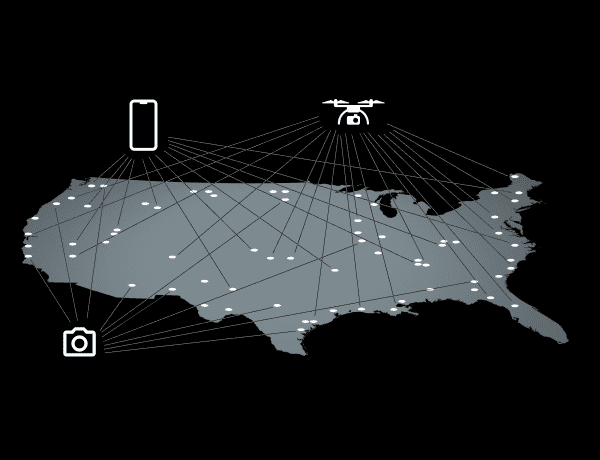

Using imagery to digitize your stockpiles to create verified Stockpile Reports so you know the volume and condition of every stockpile at any time.

What is a Stockpile Report?

Our algorithms automatically analyze imagery and identify potential risks to bulk materials estimates from measurement to measurement for precision. Every Stockpile Report includes a 3D visualization to represent the volume and condition of every pile, with a confidence score based on surface and toe calculations for each stockpile, as well as identification of risks associated with each pile, from obstructions to site conditions.

Our Plans

Personal

$0/ month

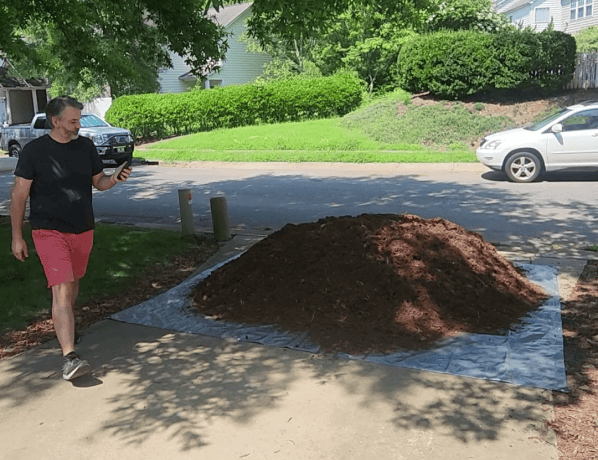

Are you an individual who occasionally needs a single measurement with your phone on any given day?

1 User

1 Measurement per day

Measure with an iPhone

Freestanding piles

Save measurements locally

Limited Time on Android

1 User

Unlimited measurements

Measure on a Samsung Galaxy S25

Freestanding piles

Measurements are not saved or stored

Professional

$20/ month

Are you an individual who needs 1 or more measurements of freestanding piles or materials stored in bunkers with your phone on any given day?

1 User

Unlimited measurements

Measure with an iPhone

Freestanding piles

Bunkers and bins

Save measurements locally

Business

Are you a small business owner who would like a team performing unlimited measurements with their phone?

Starts at 1 user

Unlimited measurements

Measure with an iPhone

Freestanding piles

Bunkers and bins

Cloud portal and dashboard

Manage piles by product & site

Reports in tonnage

Share measurements

Enterprise

Contact Us

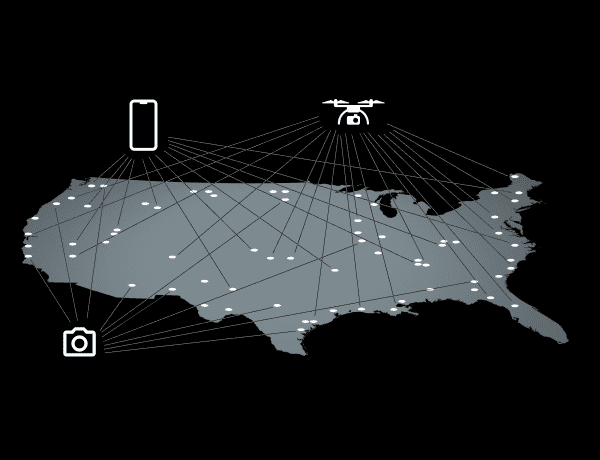

Are you a large enterprise with 100s of stockpiles spread across multiple states, countries, or continents that needs to conduct massive inventory counts quickly with phones, drones, and installed cameras?

Unlimited users

Unlimited measurements

Measure with an iPhone

Measure with drones

Installed cameras

Freestanding piles

Bunker and bins

Cloud processing

Cloud portal and dashboard

Manage piles by product & site

Reports in tonnage

Verified reports

Surface & toe confidence scores

Share measurements

Dispute resolution

User hierarchies

Personal

$0/ year

Are you an individual who occasionally needs a single measurement with your phone on any given day?

1 User

1 Measurement per day

Measure with an iPhone

Freestanding piles

Save measurements locally

Limited Time on Android

1 User

Unlimited measurements

Measure on a Samsung Galaxy S25

Freestanding piles

Measurements are not saved or stored

Professional

$200/ year

Are you an individual who needs 1 or more measurements of freestanding piles or materials stored in bunkers with your phone on any given day?

1 User

Unlimited measurements

Measure with an iPhone

Freestanding piles

Bunkers and bins

Save measurements locally

Business

Are you a small business owner who would like a team performing unlimited measurements with their phone?

Starts at 5 users

Unlimited measurements

Measure with an iPhone

Freestanding piles

Bunkers and bins

Cloud portal and dashboard

Manage piles by product & site

Reports in tonnage

Share measurements

Enterprise

Contact Us

Are you a large enterprise with 100s of stockpiles spread across multiple states, countries, or continents that needs to conduct massive inventory counts quickly with phones, drones, and installed cameras?

Unlimited users

Unlimited measurements

Measure with an iPhone

Measure with drones

Installed cameras

Freestanding piles

Bunker and bins

Cloud processing

Cloud portal and dashboard

Manage piles by product & site

Reports in tonnage

Verified reports

Surface & toe confidence scores

Share measurements

Dispute resolution

User hierarchies

Trusted By