For decades, the aggregates industry has run on instinct. Site managers relied on gut feel, clipboards, and manual counts to keep operations moving. It worked — until the industry grew in scale and complexity. Today, that way of working feels like an old playbook in a new game.

That’s beginning to change. Just as Moneyball reshaped baseball by replacing gut instinct with statistics, aggregates is having its own Moneyball moment. Data is finally becoming the ground truth for decisions. But unlike baseball — where teams crunch numbers after the game — aggregates businesses are heading toward a real-time playbook, where every decision is called on the field as the action unfolds.

From Guesswork to Ground Truth

Bulk materials are the backbone of construction, yet historically the supply chain has been fragmented and opaque. A pile of rock doesn’t have a barcode. Weather, shifting material, and dust have made automation hard.

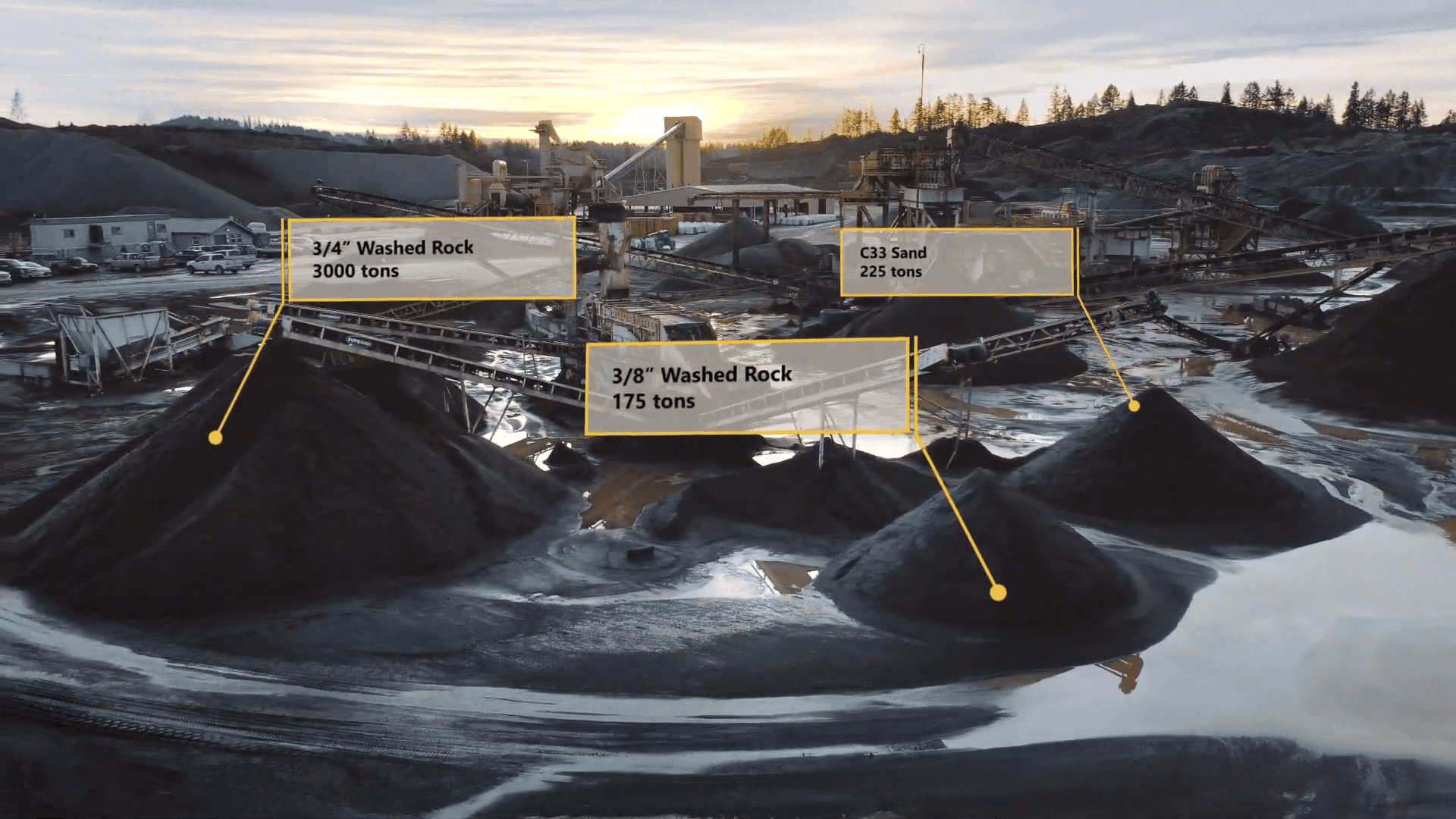

Now, with phones, drones, and fixed cameras connected through AI-enabled computer vision, every pile can be measured, any time. That means replacing assumptions with trusted data, and turning a patchwork of clipboards, spreadsheets, and estimates into an integrated, real-time supply chain.

“It’s like giving the supply chain its own set of eyes and brain,” says David Boardman, founder and CEO of Stockpile Reports

The Big Rock Math Advantage

The financial potential of this transformation is what Stockpile Reports calls “big rock math.” Access to real-time data in the bulk materials industry addresses chronic dysfunction in decision-making and eliminates a drain on profitability. Here are four key inefficiencies uncovered in studies across major producers:

- Inefficient Sales Efforts

Sales teams often spend hours manually verifying inventory levels by visually inspecting piles or walking them with measuring tools. This time could be better spent engaging with customers and booking orders.- Big rock math insight: For a producer with 200 million tons of annual output, a 10% improvement in efficiency translates to a margin gain on 20 million tons. At $5 per ton, that’s a $100 million profit opportunity.

- Materials Shortages

Inventory inaccuracies frequently result in selling materials that don’t exist. To fulfill commitments, companies must transport rock from other sites or purchase from competitors, reducing margins due to higher transportation and procurement costs. Conversely, underreported inventory can lead to lost sales opportunities when materials are inaccurately shown as unavailable.- Big rock math insight: Many domestic producers operate below capacity, leaving idle resources untapped. For a producer with 400 sites yielding 200 million tons annually, idle capacity often matches the output, underscoring the urgent need to optimize inventory.

- Operational Productivity Drain

Mistrust in perpetual inventory records forces site managers and their teams to perform redundant inventory counts and verifications. Weekly calls, daily checks, and manual tracking waste significant time and resources.- Big rock math insight: Reducing these inefficiencies could save over 150,000 labor hours annually—equivalent to 75 full-time employees and $3 million in labor cost savings.

- Excess Materials Inventory

A pervasive “fear of running out” (FORO) compels sites to stockpile excess material beyond operational needs. One site was found to maintain over six weeks’ worth of inventory for certain materials, despite being able to reduce this by 60% without risk.- Big rock math insight: For a producer with $100 million in inventory, cutting excess stock by 60% could free up $60 million in working capital, enabling reinvestment in growth and operational improvements.

Beyond the Box Score: A Connected Ecosystem

What’s next goes beyond the “Moneyball” stage of simply crunching stats. The future is a connected playbook where intelligence flows across the entire construction ecosystem:

- Inside a company – production, dispatch, logistics, jobsite delivery, and customer service all run from the same real-time data.

- Across the industry – quarries, ready-mix plants, DOT projects, and customers share a single source of truth.

Imagine every business system enriched by stockpile intelligence, where dependencies between production, transportation, and demand are framed by the ground truth of every pile. Waste is minimized, margins expand, and the entire industry operates with new confidence.

The AI-Driven Playbook

AI will push this further:

- Language models will make data instantly available: “What did we produce yesterday?” answered in seconds.

- Computer vision will move beyond volumes to tell you spec, moisture content, and storage risks from a single photo.

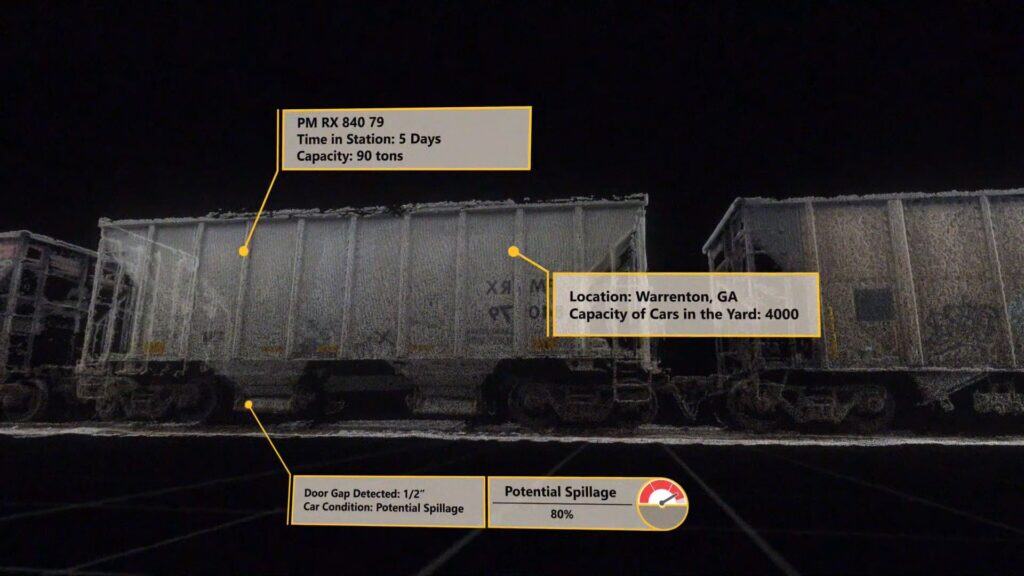

- EveryPoint, the engine behind Stockpile Reports, will know where every asset is — from loaders to rail cars — and their condition, closing the loop between demand and production.

This isn’t about replacing crews. It’s about eliminating unsafe, low-value, and inefficient tasks. Instead of visual guesses, walking wheels, or perpetual systems, crews will have time to focus on higher-value roles: driving efficiency in production, excelling at meeting customer demand and running equipment at optimal levels.

From Gut Feel to Winning Strategy

The industry’s future lies in shifting from instinct to intelligence. Stockpile Reports is building that intelligence layer — the real-time playbook that transforms data into insights for action and action into profit.

It’s time to stop guessing. It’s time to start winning.

Ready to put intelligence into your piles? Book a Demo with Stockpile Reports and see how we can help.